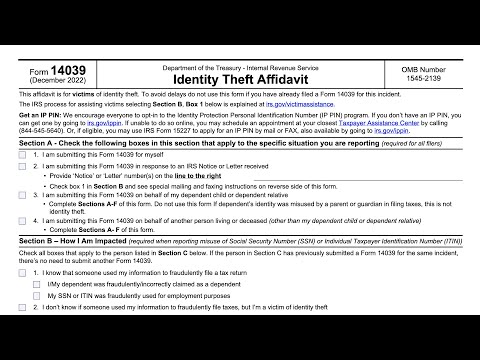

Be going over IRS form 14039 identity theft affidavit so this is an affidavit for victims of identity theft if you've already filed this form you do not need to file it again refiling a form that's already been filed will only slow the IRS process down probably the most important part of this is that most cases taxpayers do not need to complete identity theft affidavit to the IRS unless they believe that they've been a victim of tax related identity theft and uh even then only if you've not received a letter from the IRS indicating that you might have been a victim of identity theft so if you believe you've been a victim of tax related identity theft then and you haven't received notification from the IRS then you should probably um complete this form this form is two pages so it's fairly straightforward here are some signs that that might indicate whether or not you've been a victim of identity theft ing to the IRS website so if you can't e-file your tax return because there's a duplicate tax return already filed using your social security number that might be an indication it also might be an indication of a transposed Social Security number so double check your social security number just to make sure that your entry is accurate if you can't e-file because one of your dependents Social Security numbers or tax ID numbers has already been used then that might be a sign of identity theft if you receive a tax transcript in the mail that you did not request if you receive a notice from a tax preparation company confirming an online account was created in your name even though you did not create an account if you receive a notice from...

PDF editing your way

Complete or edit your irs form 14039 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export irs form 14039 printable directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 14039 print as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your en formulario 14039 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 14039 (SP)

About Form 14039 (SP)

Form 14039 (SP) refers to the Identity Theft Affidavit form provided by the Internal Revenue Service (IRS) in the United States. It is a specialized version of Form 14039 designed for individuals who are Spanish-speaking and prefer to complete the form in Spanish. Form 14039 (SP) is used by taxpayers who believe they have become victims of identity theft or suspects that someone has used their personal information for fraudulent purposes related to their taxes. The form is used to notify the IRS about the identity theft incident, report any fraudulent activity, and declare that the individual is not personally responsible for the related tax liabilities. The form asks for various information, such as personal details, identification numbers, specific instances of fraudulent tax filing or misuse, and other necessary supporting details. Once completed, the form needs to be signed and submitted to the IRS, either through mail or fax, following the instructions provided by the IRS. It is crucial for individuals who have experienced identity theft and suspect any fraudulent activity related to their tax accounts to promptly fill out Form 14039 (SP) and submit it to the IRS. This form helps initiate the necessary actions by the IRS to investigate the identity theft case, protect the taxpayer's account, and prevent any further misuse of their personal information for tax-related purposes.

What Is 14039?

Online technologies make it easier to organize your file management and raise the productivity of your workflow. Follow the brief guideline as a way to fill out Irs 14039?, stay away from mistakes and furnish it in a timely way:

How to fill out a 14039 form?

-

On the website hosting the document, click on Start Now and move towards the editor.

-

Use the clues to complete the pertinent fields.

-

Include your individual data and contact data.

-

Make certain that you choose to enter proper details and numbers in suitable fields.

-

Carefully revise the written content of the form so as grammar and spelling.

-

Refer to Help section should you have any issues or contact our Support team.

-

Put an digital signature on your 14039? Printable with the support of Sign Tool.

-

Once document is done, press Done.

-

Distribute the ready via electronic mail or fax, print it out or download on your device.

PDF editor enables you to make changes towards your 14039? Fill Online from any internet linked device, personalize it in keeping with your requirements, sign it electronically and distribute in several ways.

What people say about us

The best way to submit templates without having mistakes

Video instructions and help with filling out and completing Form 14039 (SP)