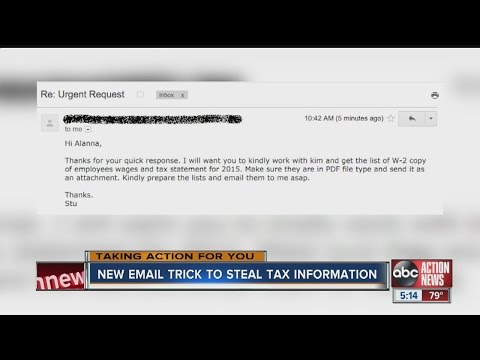

Taking action for you tonight. Not fun to imagine if your payroll department emailed your tax info to a complete stranger. Yeah, well, that's exactly what happened, though, to several major companies in the past month, including Evening Post Industries in South Carolina and Main Line Health in Pennsylvania. ABC Action News reporter Adam Winer joins us down to the studio with how this could happen and what you should watch for. Adam, what's scary is this could really happen to any company. It starts with an email that looks like this. It's sent to a company's payroll department. The sender pretends to be the company's CEO, even makes the email appear to be from the CEO. This is the newest trick this tax season, and so far it's been very effective. It was a crime of opportunity. I parked my car, I locked my door, and like, I went into the store. It took just 15 minutes for someone to steal Carol Santos's purse and peace of mind. I came back to look for my purse to make a payment, it was gone. Gone was her cash, four credit cards, and now she fears her tax return as well. My tax guy told me to file my taxes for it's probably that would help, but I don't think it's helping. It's a common crime. The IRS admits it paid out 5.8 billion dollars in fraudulent refunds in 2013, and this tax season, thieves are finding even more creative ways to steal your identity. Spoofing is they make it look like it comes from someone you know, like your CEO saying urgent request, please send me all the w2 information of all employees. Stoosh our men is a cybersecurity expert whose company closes security loopholes and trains people on how...

Award-winning PDF software

W2 stolen irs Form: What You Should Know

Tax-Related Identity Theft Victim Assistance and Submit Sep 2, 2025 — You tell us you may be a victim of tax-related identity theft. · File a paper tax return if you are unable to e-file · Complete Form 14039, Tax-Related Identity Theft Victim Assistance and Submit Sep 10, 2025 — Form 14039, Tax-Related Identity Theft Victim Assistance, is for victims of tax- related identity theft. Form 14039: Identity Theft and Tax Fraud In tax fraud and identity theft, fraudsters use your personal information to open fraudulent bank accounts and other accounts for fraudulent use, to obtain credit, for obtaining cash, for fraudulent purchases, to make illegal purchases, to commit credit card fraud, to purchase items at pawnshops to obtain cash for fraudulent uses, for making illegal online purchases from companies owned by the victim, and to obtain merchandise at stores owned by the victim. The perpetrator of tax-related identity theft generally uses a stolen SSN to open a checking account that then becomes a checking account at a bank or to make fraudulent telephone or credit card calls using the victim's SSN to fraudulently open additional checking and savings accounts with such bank. Taxpayers should be prepared for the possibility of identity theft, particularly if you believe that the information or transaction involving your tax refund claim or tax refund may have been compromised by fraud. Taxpayers should be alert to the possibility that their SSN may be used for improper purposes. Do not use personal information or Social Security numbers when making tax or insurance applications, using credit or debit cards, or opening or operating a bank account. The IRS will use IRS Social Security numbers in accordance with established procedures and regulations to process tax returns and claims. Once the taxpayer's SSN has been linked to the taxpayer's tax return, the taxpayer cannot use the SSN for purposes other than processing the taxpayer's tax claim, the tax return, and related tax-related correspondence. The IRS relies on the information contained in the taxpayer's tax return and any other related correspondence that the taxpayer receives to protect the integrity of our tax system. Taxpayers should immediately notify the IRS if they become aware of fraud and should maintain records of these notifications. If you are a victim of tax fraud or identity theft please call the Identity Theft Hotline at (TTY:).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14039 (SP), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14039 (SP) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14039 (SP) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14039 (SP) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W2 stolen irs